pa educational improvement tax credit individuals

Credits are first-come first-served and often fully utilized on opening day so CSFP will help you apply. Your donation will help to transform barren asphalt.

Education Tax Credits And Deductions For 2021 Taxes Bankrate

This credit will reduce their state tax liability on a dollar-for-dollar basis.

. Free means free and IRS e-file is included. Individual donors need to work for a business W-2 or own a Pennsylvania business to use the SPE EITC tax credit. Pennsylvanias Educational Improvement Tax Credit EITC program is a way for businesses to enrich educational opportunities for students and earn tax credits by donating to an Educational Improvement Organization.

Start Your Tax Return Today. This translates to a tax credit of 3150 which will be usedrefundable if donors Pennsylvania income is 102606 or higher. Educational Improvement Tax Credit EITC.

Educational Improvement Tax Credit EITC Opportunity Scholarship Tax Credit Program OSTC and Educational Improvement Organization EIO Programs. Through EITC eligible businesses can receive tax credits equal to 75 of their contribution up to 750000 per taxable year. There are two ways to participate and you may qualify for both.

Educational Improvement Tax Credit Program EITC Opportunity Scholarship Tax Credit Program OSTC. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Max refund is guaranteed and 100 accurate.

Ad Access Tax Forms. For example a family with one child must have an income below 113693 whereas a family with three children must have an income below 147727 The figures will increase in future years to adjust for inflation. The remaining 10 of the payment is also eligible for a federal charitable contribution deduction.

Read more about renewals. Ad All Major Tax Situations Are Supported for Free. Businesses can receive up to 750000 in tax credits per year.

Through the Educational Improvement Tax Credit program individuals and businesses direct a portion of their Pennsylvania state income tax dollars towards scholarships at State College Friends School and other Quaker schools across the state. Qualified individuals can make a contribution and receive 90 of the contribution back as a dollar-for-dollar reduction of their. Complete Edit or Print Tax Forms Instantly.

The Educational Improvement Tax Credit EITC and Opportunity Scholarship Tax Credit OSTC programs provide tax credits to eligible individuals contributing to the Scholastic Opportunity Scholarship Fund via one of the Special Purpose Entities formed for the benefit of the Scholarship Organization at the Diocese of Pittsburgh. The Trust for Public Land is honored to be a Pennsylvania Educational Improvement Tax Credit EITC non-profit participant. Donate at least 3500 in one check to the SPE.

Educational Tax Credits Keystone Innovation Zone KIZ Tax Credit Keystone Special Development Zone KSDZ Historic Preservation Tax Credit Tax Credit for New Jobs Neighborhood Assistance Program Resource Enhancement and Protection REAP Tax Credit Entertainment Production Tax Credit Entertainment Economic Enhancement Program. 737 rows List of Educational Improvement Organizations Effective 712015 6302016 EITC. 96676 17017child Prior Year Public School Requirement.

Yes this means you too can receive a 90 PA income tax credit by. As such qualified businesses and individuals who pay Pennsylvania taxes are eligible to receive up to a 90 tax credit for donations to The Trust for Public Lands green schoolyards work in Philadelphia. The State of PA created the opportunity for individuals to receive the same 90 PA income tax credits as corporations.

1 As a business you may participate through the traditional program as described below. Irrevocable election to pass Educational Improvement Tax Credit EITCOpportunity Scholarship Tax Credit OSTC through to shareholders members or partners. Individuals and businesses who participate in this program receive a state income tax credit equal to 90 of their donation.

REV-1123 AXES EDUCATIONAL IMPROVEMENT PO BOX 280604 17128-0604 OPPORTUNITY SCHOLARSHIP TAX CREDIT. Ad Get Help maximize your income tax credit so you keep more of your hard earned money. Tips Services To Get More Back From Income Tax Credit.

Companies entering year 2 of a two-year tax credit commitment or companies renewing a two-year commitment that just ended must apply on May 15. A separate election must be submitted for each year an EITCOSTC is awarded. 2 As an individual you may participate through a Special Purpose Entity SPE the new era of EITC funding if you have a minimum PA tax liability of 3500.

Schneider Downs is the 13th largest accounting firm in the Mid-Atlantic region and serves individuals and companies in Pennsylvania PA Ohio OH West Virginia WV New York NY Maryland MD and additional states in the United States with offices in Pittsburgh PA Columbus OH and McLean.

Follow Senator Scott Martin S Senatormartinpa Latest Tweets Twitter

Pa Eitc Tax Credit Explained Central Pennsylvania Scholarship Fund

About Pennsylvania S Educational Improvement Tax Credit Eitc Whyy

Eitc Explained How Pennsylvania S Educational Tax Credits Are Used Who Benefits And More Pennsylvania Capital Star

Eitc Explained How Pennsylvania S Educational Tax Credits Are Used Who Benefits And More Pennsylvania Capital Star

Eitc Explained How Pennsylvania S Educational Tax Credits Are Used Who Benefits And More Pennsylvania Capital Star

About Pennsylvania S Educational Improvement Tax Credit Eitc Whyy

Eitc Explained How Pennsylvania S Educational Tax Credits Are Used Who Benefits And More Pennsylvania Capital Star

Tax Credit Program Overview Blocs

Western Pennsylvania Montessori School

About Pennsylvania S Educational Improvement Tax Credit Eitc Whyy

Jewish Scholarship Llc Jewish Education Scholarship

Life Swork Of Western Pa Home Facebook

Tax Credit Program Overview Blocs

Episcopal Academy The Pa Tax Credit Program

Tax Credit Program Overview Blocs

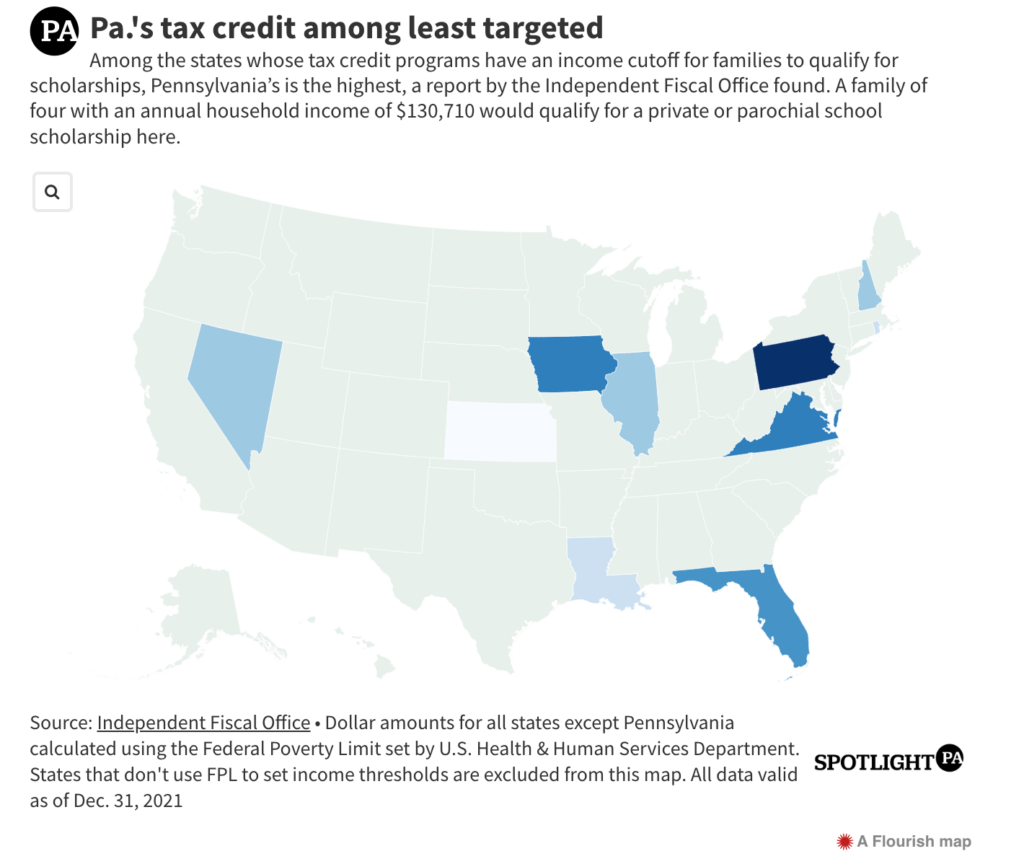

New Pa Budget Injects 125m Into Private School Tax Credit Program That Lacks Basic Accountability Whyy

New Pa Budget Injects 125m Into Private School Tax Credit Program That Lacks Basic Accountability Whyy